Business Retirement Plans

In today’s employment environment, it is more important than ever for employers to provide incentives to retain employees. One such benefit can be found in retirement plan offerings. There are several types of retirement plan options available to small businesses. While the same plan is not necessarily perfect for every company – the size and ownership structure of the company can help inform business owners’ decision as to which plan to offer.

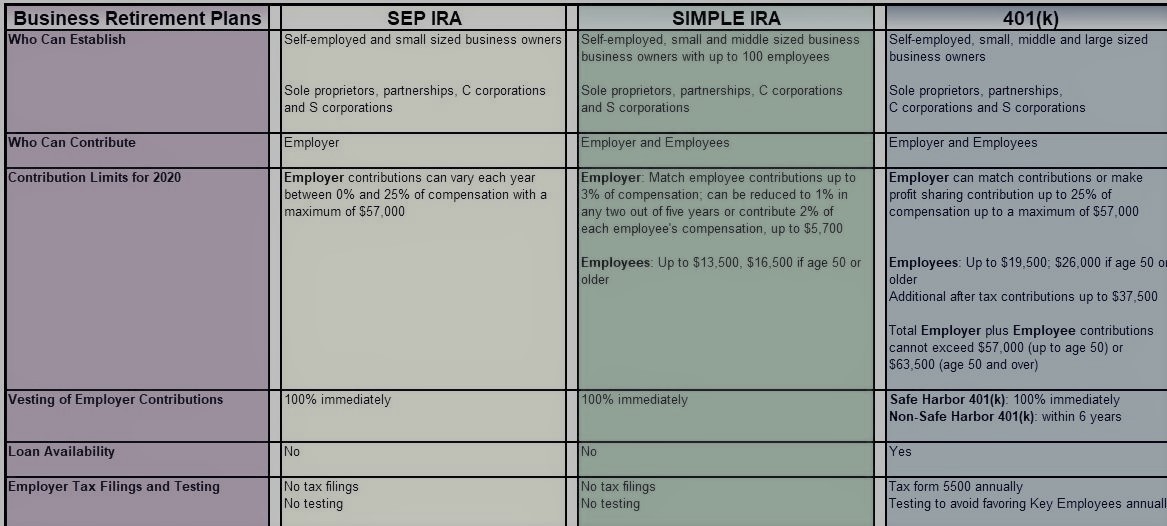

Some of the factors to consider when choosing a plan are affordability, the demographics of your employees, contribution limits and administrative requirements. I am equipped to assist businesses to make informed decisions and set retirement goals. Below is a chart explaining some of the basic details of business retirement plans

If you are a business owner and would like guidance on which plan would suit you and your employees best, please schedule an appointment today.

About the author

Athena K. Stone has been with Attentive Investment Managers, Inc. since 2003, is an Investment Advisor and the Chief Compliance Officer for the company. Mrs. Stone earned her Chartered Retirement Planning Counselor (CRPC) designation in 2010 from the College for Financial Planning. She received the designation of Accredited Investment Fiduciary (AIF) from Fi360 in 2011. She earned her Bachelor of Arts Degree in Organizational Leadership from Brandman University in 2012 and her Master of Science in Financial Planning and Designation of MPAS (Master Planner Advanced Studies) from the College for Financial Planning in 2018.

By accepting you will be accessing a service provided by a third-party external to https://www.attentiveinv.com/

Comments