Important Information about the American Rescue Plan

Stimulus Check

Eligibility for the $1,400 (per person) stimulus check will be based on your reported income from either your 2019 or 2020 (if filed) tax return. Individuals will be eligible if they have an AGI of $75,000 or less and Married couples with an AGI of $150,000 or less. The income cap is $80,000 and $160,000 respectively. Many people have already received their stimulus payment or will within the coming weeks. You may still use the “Get my payment” tool on IRS.gov to find out specific details regarding your payment.

PPP

The American Rescue Plan Act appropriates just $7.25 billion in additional funding and does not extend the PPP's current application period, which is scheduled to close March 31.

The plan does make more not-for-profits eligible for the PPP by creating a new category called "additional covered nonprofit entity," which are those not-for-profits listed in Sec. 501(c) of the Internal Revenue Code other than 501(c)(3), 501(c)(4), 501(c)(6), or 501(c)(19) organizations, that can receive an initial PPP loan.

RRF

Restaurants and bars have been among the businesses most hurt by the stay-at-home and social-distancing restrictions imposed to slow the spread of COVID-19. The $25 billion Restaurant Revitalization Fund (RRF) is intended to help businesses in the food services sector.

In addition to restaurants and bars, other entities eligible for support from the RRF include food stands, food trucks, food carts, caterers, saloons, inns, taverns, lounges, brewpubs, tasting rooms, taprooms, and any licensed facility or premise of a beverage alcohol producer where the public may taste, sample, or purchase products, or other similar place of business in which the public or patrons assemble for the primary purpose of being served food or drink.

The act allows for grants equal to the pandemic-related revenue loss of the eligible entity, up to $10 million per entity, or $5 million per physical location. The grants are calculated by subtracting 2020 revenue from 2019 revenue.

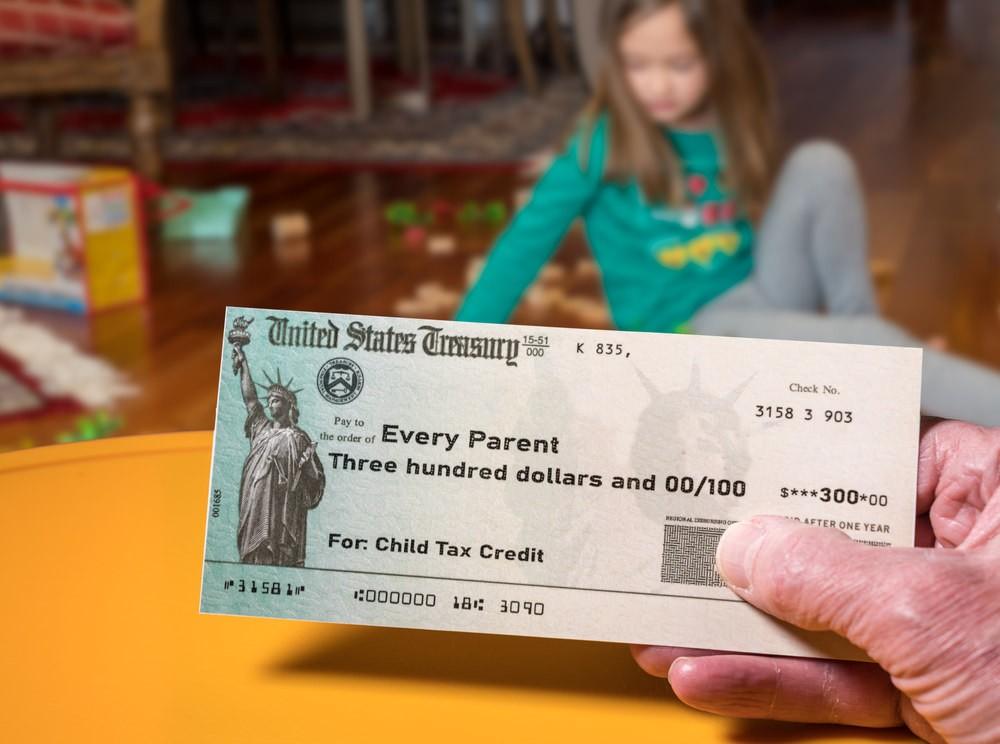

Child Tax Credit

In the tax year 2021, under the new provisions, families are set to receive a $3,000 annual benefit per child ages 6 to 17 and $3,600 per child under 6. The credit will also be fully refundable. The IRS could start providing advances on the 2021 credit through periodic payments of $250 for school-aged children starting as early as July 2021, depending on what the Treasury Department determines is workable. Under the proposed schedule, which could be as frequent as monthly, families could receive half of their total 2021 child tax credit this year and claim the remaining amount on their 2021 tax returns.

Unemployment Benefits

Unemployment Benefits have been extended through September 6th and those eligible will receive an additional $300 per week from the Federal Government. Additionally, for those who had unemployment benefits during 2020 and your income was below $150,000 per year you will not be taxed for the first $10,200. Importantly, if you have already filed your 2020 tax return prior to the passage of this bill you MAY need to amend your 2020 return – the IRS should be issuing additional guidance, or you can reach out to your CPA regarding this item.

About the author

Athena K. Stone has been with Attentive Investment Managers, Inc. since 2003, is an Investment Advisor and the Chief Compliance Officer for the company. Mrs. Stone earned her Chartered Retirement Planning Counselor (CRPC) designation in 2010 from the College for Financial Planning. She received the designation of Accredited Investment Fiduciary (AIF) from Fi360 in 2011. She earned her Bachelor of Arts Degree in Organizational Leadership from Brandman University in 2012 and her Master of Science in Financial Planning and Designation of MPAS (Master Planner Advanced Studies) from the College for Financial Planning in 2018.

By accepting you will be accessing a service provided by a third-party external to https://www.attentiveinv.com/

Comments