The Role of Bonds

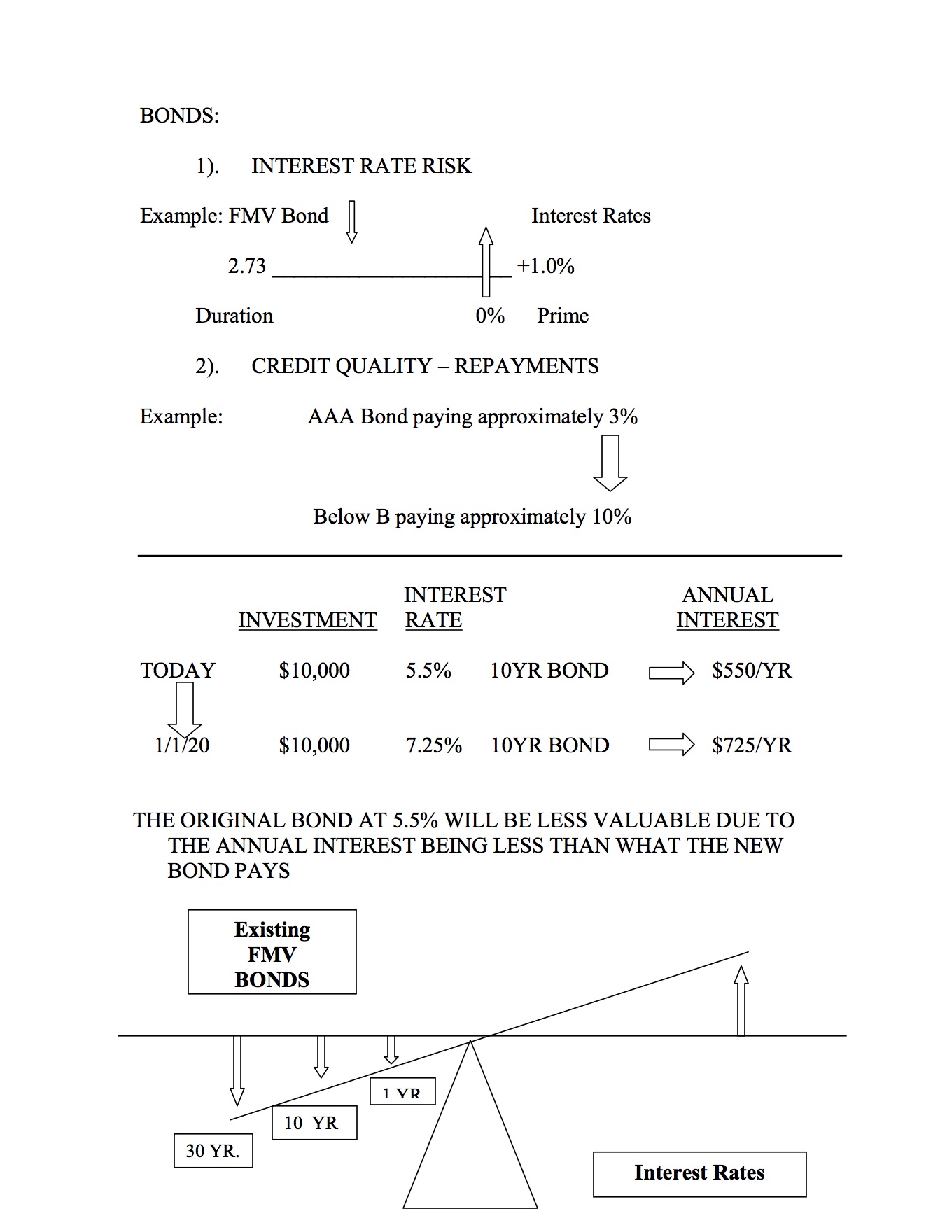

Bond prices go down when rates go up, and rates are beginning to do just that. Preceding the current environment, we had nearly 30 years of declining interest rates and about 8 years of nearly zero rates. U.S. equities are up, and we are all holding our breath in anticipation of the all-time high 20,000 mark on the DOW so why would someone want to buy bonds?

The purpose of bonds in a portfolio is not to generate massive returns.Bonds are an agent of protection against the most dreaded market risk – a crash in equities.In 2008, the last time the markets crashed a allocation that included bonds could have achieved a positive return while at that time stocks were losing 37%, meaning bonds were outperforming stocks. This is not to say that we are going to have a market downturn however, over time, investors holding bonds in their portfolio often experience a less bumpy market ride and fewer losses during downturns.

In the bond markets, it's possible that the decades-long bull market—which basically means declining interest rates—has ended, and the fixed-income world is experiencing rate rises. But despite the nudge by the Federal Reserve Board, the moves have not exactly been dramatic. Over the past year, rates on 10-year Treasury bonds have risen from 2.25% to 2.44%, while 30-year government bond yields have risen from 3.00% to 3.07%. According to Barclay's Bank indices, U.S. liquid corporate bonds with a 1-5 year maturity have seen yields rise incrementally from 2.4% to 2.8% on average.

Now that rates are rising, you may experience some loss in your bond values however, with the help of an Advisor, like us, there are ways to reduce the risk associated with bonds. Some ways of doing so are reducing the maturity or duration of your bonds, holding more cash and diversifying the credit quality of your bond holdings.

About the author

Athena K. Stone has been with Attentive Investment Managers, Inc. since 2003, is an Investment Advisor and the Chief Compliance Officer for the company. Mrs. Stone earned her Chartered Retirement Planning Counselor (CRPC) designation in 2010 from the College for Financial Planning. She received the designation of Accredited Investment Fiduciary (AIF) from Fi360 in 2011. She earned her Bachelor of Arts Degree in Organizational Leadership from Brandman University in 2012 and her Master of Science in Financial Planning and Designation of MPAS (Master Planner Advanced Studies) from the College for Financial Planning in 2018.

By accepting you will be accessing a service provided by a third-party external to https://www.attentiveinv.com/

Comments